Jaguar Car Insurance

- Brand ValueCheck in your City

- Versatile Designs

- World Class Safety

- Dependable and Practical

- Innovation and Performance Quality

Top Car Insurance Plans

- CASHLESS GARAGES 8000+

- CLAIMS SETTLED 100%

- ZERO DEP. CLAIMS UNLIMITED

Maximum Cashless Garages

Over Night Vehicle Repairs

24x7 Roadside Assistance

Quick Claim Settlement

- CASHLESS GARAGES 3,100

- CLAIMS SETTLED 95%

- COMPREHENSIVE CLAIMS UNLIMITED

Towing Assistance (For Accidents)

Coverage Outside India

PSU Provider

Quick Claim Settlement

Car Insurance Premium for Jaguar Car Variants

| Car Model | Variant of the Car | Comprehensive Car Insurance | Third Party Car Insurance | Own Damage Car Insurance | |

| Jaguar XF | 2.0 Petrol R-Dynamic S | ₹ 2094 | ₹ 7897 | ₹ 21719 | |

| Jaguar XJ | 3.0L Portfolio | ₹ 48017 | ₹ 7897 | ₹ 42075 | |

| Jaguar F-TYPE | R-Dynamic Black | ₹ 2094 | ₹ 2094 | ₹ 45787 | |

| Jaguar F-Pace | 5.0 SVR | ₹ 2094 | ₹ 2094 | ₹ 38449 | |

| Jaguar XE | S Diesel | ₹ 44953 | ₹ 7897 | ₹ 17257 | |

| Jaguar XK | 5.0L V8 Petrol Coupe | ₹ 68340 | ₹ 7897 | ₹ 66119 | |

| Jaguar I-Pace | Black | ₹ 140251 | ₹ 6712 | ₹ 61617 |

Calculate Jaguar Car Insurance

Select your car brand

- Maruti

- Hyundai

- Honda

- Toyota

- Mahindra

Which city is your car registered in?

- Ahmedabad

- Bangalore

- Chandigarh

- Chennai

- Gurgaon

When did you buy your car?

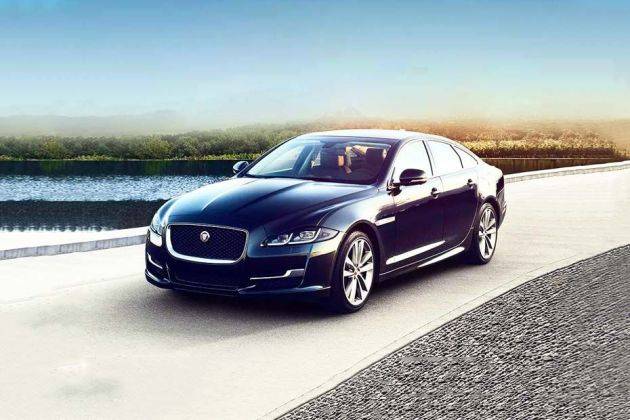

About Jaguar

Jaguar is a British luxury vehicle company that is now owned by Tata Motors, one of the largest automotive manufacturers in the world. Jaguar has been in India since the year 2009. The models of Jaguar are renowned for their sportiness and smooth handling. Jaguar’s India models which are widely appreciated comprise the XE, XF and XJ sedans, the F-Pace SUV and the F-Type sports car. However, the I-Pace electric SUV will go on sale in India in 2021.

Car Insurance Renewal Process for Jaguar Cars

The timely renewal of Jaguar cars is vital to keep the car insurance coverage active. Hence, you should renew your car insurance plan before its expiry date to keep your car insured and protected. Here are the steps to renew your Jaguar car insurance policy:

Step 1: Go to the website of InsuranceDekho and select the ‘car’ tab.

Step 2: Enter details of your car such as car make, model and variant, registration number, fuel type, etc., to proceed. If you do not know the registration number of your car, then you can select ‘Don’t know your car number?’ link, wherein you are required to choose your car’s make, model, registration year, fuel type, variant, etc., to continue.

Step 3: Enter the details of your previous car insurance policy and insurance company. Also, you need to share if you have made any claim in the previous policy term or not and then click on the ‘Continue’ button.

Step 4: Fill in your personal details such as name, phone number, and term for which you need to get your car insured under a car insurance policy. Then, click on ‘submit and Get Quotes’.

Step 5: Based upon your entries, different policy premium quotes from different insurers will appear on your screen. After comparing the policy quote results, you can pick an ideal policy based on your budget and need. At this level, you can also opt for some add-on covers to be included in your policy.

Step 6: Initiate the payment process by clicking on the ‘Buy Now’ tab to renew your Jaguar car. You can make payments via gateways like debit card, credit car, net banking, and online wallets. After the payment, the car insurance policy documents will get issued and sent to the registered Email ID.

Claim Cashless Car Insurance for Jaguar Cars

The cashless car insurance process helps you get your Jaguar car repaired at any network garage of your insurance company. After an accident, you can take your car immediately to any garage authorised by your insurer. However, to avail this cashless claim option you should instantly intimate your insurance provider about the accident or mishap. The cashless car insurance option allows you to get your car repaired without paying anything as the repair cost is to be settled by your insurer after verifying your car repair invoice and other required documents.

The cashless car insurance claim is the most ideal facility for every policyholder as it saves them from making hefty repair costs soon after an accident. Also, this option requires them to submit fewer documents and go through lesser paperwork. Under this process, the insurance company sends a surveyor to examine the damage extent after the accident as the repair work tends to begin only when the insurer approves the report sent by the surveyor. The insurance companies authorise the best workshops due to which the policyholder can get the best repair services for free.

Documents Required for Jaguar Car Claim

Following are the documents required to file a Jaguar Car Insurance claim:

- Claim Form

- Copy of FIR

- Copy of Registration Certificate

- Copy of Driver’s Licence

- Copy of Pollution Under Control Certificate (PUC)

- Copy of Car Insurance Policy Document

- Copy of Pan Card - for claims higher than Rs. 1 Lakh

- Satisfaction Voucher

Steps to File Jaguar Car Insurance Claim

You can follow the below-mentioned steps to file a claim for your Jaguar car:

Step 1: In case of a road accident, theft or a case of vandalism first file an FIR at the nearest police station. A copy of the document will be required for the claim process. However, if the damage occurred due to a natural or manmade calamity make sure to take pictures and videos of the damage if possible.

Step 2: Inform the insurance provider of the situation as soon as possible. Also, remember to confirm the list of documents you are required to submit to the insurance company. The standard list of documents is mentioned above.

Step 3: Submit the required documents along with a duly filled claim for to the insurance provider.

Step 4: If the car needs to repair the insurance provider will schedule a surveyor to visit. They will assess the damage and draw up a report after which your claim will go through a verification process.

Step 5: Once approved, you can take your car to the nearest network garage and get it repaired. Once they are done sign the satisfaction voucher and the insurance company will handle the bill directly with the garage in a cashless manner. If you choose to go to a non-network garage the insurance company will reimburse the money after you submit the original invoice. However, keep in mind the reimbursement will take into account the IDV of the car.

If there is a case of total loss or the car was stolen, however, the insurance provider will compensate the IDV of the car after you hand in the keys, documents or other items related to the car.

Add-ons For Your Jaguar Car Insurance

Explore Car Insurance

Jaguar Car Insurance FAQs

-

How long does it take to renew a Jaguar car insurance?

You can get your Jaguar car insurance renewed in just 5 minutes with InsuranceDekho.

-

Which all insurance add-ons should be bought with Jaguar cars

For Jaguar Insurance, The popular car insurance add-ons opted with Jaguar cars include zero depreciation add-on, engine cover, NCB (No Claim Bonus) cover and RSA (Road Side Assistance) cover among others.

-

From where can I purchase insurance for my Jaguar car

You can visit our website insurancedekho.com, compare all available premium quotes for Jaguar cars and select the one which best suits your requirements. With InsuranceDekho, get policy issued instantly.

-

Which insurer has the best claim settlement ratio for Jaguar cars?

Acko General Insurance, Bharti AXA General Insurance and ICICI Lombard General Insurance are among the car insurers who have registered impressive claim settlement ratio for Jaguar cars.

-

How can I buy a car insurance policy for my Jaguar car online?

There are two ways to buy a car insurance policy online which include visiting the official website of the insurance company of your choice or by visiting the website of the InsuranceDekho platform.