Nissan Car Insurance

- Online Nissan car insurance renewal facility availableCheck in your City

- Offers quick and easy financial assistance

- A trusted car insurance brand in the market

- Japanese automaker known for manufacturing quality vehicles such as sedan, SUVs, concept cars etc

- A trusted and renowned car brand in the market

- Quick claim settlement

Top Car Insurance Plans

- CASHLESS GARAGES 8000+

- CLAIMS SETTLED 100%

- ZERO DEP. CLAIMS UNLIMITED

Maximum Cashless Garages

Over Night Vehicle Repairs

24x7 Roadside Assistance

Quick Claim Settlement

- CASHLESS GARAGES 3,100

- CLAIMS SETTLED 95%

- COMPREHENSIVE CLAIMS UNLIMITED

Towing Assistance (For Accidents)

Coverage Outside India

PSU Provider

Quick Claim Settlement

Car Insurance Premium for Nissan Car Variants

| Car Model | Variant of the Car | Comprehensive Car Insurance | Third Party Car Insurance | Own Damage Car Insurance | |

| Nissan Micra | XL Option CVT | ₹ 13249 | ₹ 3416 | ₹ 3047 | |

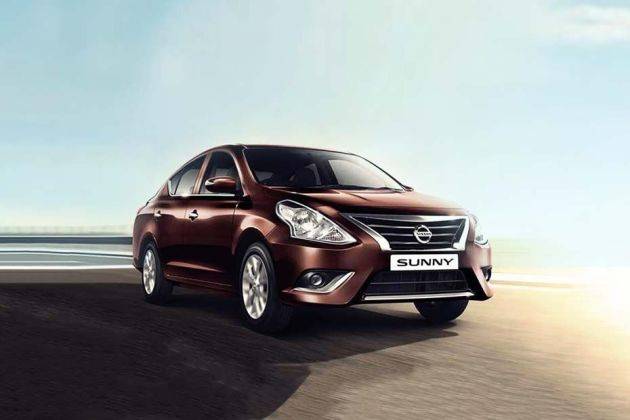

| Nissan Sunny | XE P | ₹ 13694 | ₹ 3416 | ₹ 2886 | |

| Nissan Terrano | XE D | ₹ 14956 | ₹ 3416 | ₹ 4412 | |

| Nissan Micra Active | XE | ₹ 12309 | ₹ 3416 | ₹ 2147 | |

| Nissan Kicks | XV Premium Option | ₹ 12610 | ₹ 3416 | ₹ 3539 | |

| Nissan X-Trail | New | ₹ 67940 | ₹ 7897 | ₹ 32151 | |

| Nissan Evalia | 2013 XE | ₹ 14662 | ₹ 3416 | ₹ 3965 | |

| Nissan Teana | 230jM | ₹ 34046 | ₹ 7897 | ₹ 10312 | |

| Nissan Gloria | V6 Sedan | ₹ 52849 | ₹ 7897 | ₹ 4827 | |

| Nissan Urvan | Diesel | ₹ 2094 | ₹ 2094 | ₹ 205223 | |

| Nissan Magnite | Geza Edition | ₹ 2094 | ₹ 2094 | ₹ 2407 | |

| Nissan Infiniti | Petrol | ₹ 13699 | ₹ 3416 | ₹ 5494 | |

| Nissan Primera | 2.0 16V Estate | ₹ 2094 | ₹ 7897 | ₹ 4827 | |

| Nissan Patrol | New | ₹ 2094 | ₹ 2094 | ₹ 42442 | |

| Nissan GTR | New | ₹ 120721 | ₹ 7897 | ₹ 172687 | |

| Nissan 370Z | MT | ₹ 50265 | ₹ 7897 | ₹ 46115 | |

| Nissan Jonga | Diesel | ₹ 2094 | ₹ 7897 | ₹ 5275 | |

| Nissan 350Z | Coupe | ₹ 60796 | ₹ 7897 | ₹ 65033 |

Calculate Nissan Car Insurance

Select your car brand

- Maruti

- Hyundai

- Honda

- Toyota

- Mahindra

Which city is your car registered in?

- Ahmedabad

- Bangalore

- Chandigarh

- Chennai

- Gurgaon

When did you buy your car?

About Nissan

Nissan Motor Limited is a Japanese automobile manufacturing company set up in 1933. Over the years Nissan has become one of the top automobile manufacturers of the world. The Nissan group is one of the 15 leading business houses in Japan. The Nissan Motor Company, in particular, has also been recognised for its cutting edge designs, sophisticated innovations and high-end technology in the cars they produce. Nissan arrived in India in 2005 working as a wholly-owned subsidiary Nissan Motor India Private Limited. Since its arrival in India, Nissan has created a good market for itself by delivering high-quality products at competitive prices.

Nissan Car Insurance

If you plan on purchasing a Nissan car or already own one make sure to also purchase car insurance for it. The insurance will provide a layer of protection for the car and thereby also protect its owner-driver. When you purchase car insurance, the insurance company will compensate you for any damages to your car in case of a mishap and hence provide the owner-driver with peace of mind from such uncertainties and give him/her financial stability in times of crisis.

Cars are an expensive purchase and have also become an essential part of our day. Making sure that it is running efficiently and is safeguarded in of the utmost importance. With an own-damage cover, you can protect your Nissan car from a variety of scenarios such as theft, road accidents, vandalism, natural and manmade calamities. Also, the own-damage covers offer a No Claim Bonus for claim-free years as a reward from the insurance provider. You must purchase third party insurance for your Nissan car to drive on Indian roads. Having this cover is compulsory and without it, you can be fined Rs. 2,000 and/or be imprisoned for up to 3 months according to the Motor Vehicles Act of 1988. It will take care of third party liabilities including bodily injuries, death and property damage.

The premium of your Nissan car is decided largely by the Insured Declared Value of the car. The IDV indicates the maximum compensation you can receive from the insurance provider during the claim settlement. It is calculated by deducting the depreciation rate of the car and the exclusions of the policy from the manufacturer’s selling price. The depreciation rate of the car increases with the car’s age making the IDV and the premium amount lower with time. To further strengthen your Nissan Car Insurance you can also purchase add-on covers. Add-ons are optional and you pick and choose ones to fit your needs. Here are some add-ons that could be a prudent addition to your Nissan Car Insurance:

- Zero Depreciation Cover: This add-on cover will mitigate the depreciation rate of the Nissan car during claim Settlement making the claim amount significantly higher. The add-on, however, is only available for cars that are less than 5 years old and can be used a limited number of times within a year.

- Consumables Cover: This add-on will take care of aspects of the car that are entirely used up in one go such as engine oil, nuts and bolts, filters etc. Without it, the insurance provider does not cover its cost.

- Engine Protect Cover: This add-on cover will compensate for damages to the car’s engine, usually excluded in car insurance policies. It comes especially handy if you live in a flood-prone area.

Car Insurance Renewal Process for Nissan Cars

Car Insurance is a vital tool to secure you against unforeseen events with the involvement of your Nissan car. In order to keep your car insured under car insurance, you will have to renew it every year before the date of expiry without fail. However, even if the expiry date is missed the policy can still be renewed within the grace period that is offered by the insurers to its policyholders. The grace period is generally 30 days to 90 days and it takes some amount of penalty to renew the plan. Here are the steps to renew a car insurance plan online:

Step 1: Visit the official website of the InsuranceDekho and click on the ‘Car’ tab.

Step 2: Enter your Nissan car’s Registration Number and select its variant and fuel type. If you do not know your car’s registration number, in such a case, you will have to click on the ‘Don't know your car number?’ link which will redirect to a page where you will have to select your car’s brand, model, fuel type, variant, registration year, registration city and RTO, to proceed.

Step 3: Enter the expiry date of your previous car insurance cover and your previous car insurance company’s name as well. In addition to this, tell as if you have made any car insurance claim during the last policy year or not and then click on the ‘Continue’ tab to proceed.

Step 4: Enter your personal details correctly and accurately such as your name, mobile number and policy term for which you need car insurance and click on the ‘Submit and Get Quotes’ button.

Step 5: Different car insurance policy premium quotes offered by several car insurance companies will appear on your screen. Among them, you can compare and select a car insurance policy quote that suits your needs and budget. You can also select and add some add-on covers in your car insurance policy.

Step 6: Check all the details entered by you and then click on the ‘Buy Now’ link to initiate the payment process to renew your Nissan car insurance policy. The payment can be done through debit card, credit card, net banking, or digital wallet. Once the payment is done, the insurance company will issue the car insurance policy document instantly and send it to you via email.

Claim Cashless Car Insurance For Nissan Cars

The cashless car insurance claim facility is quite simple therefore most of the car owners always prefer a cashless car insurance claim process over a reimbursement car insurance claim. Under this process, policyholders can go to the insurance company’s network garages to get their cars repaired without paying anything as the insurance company is liable to pay the repair bill directly to the garage for the services. The policyholders will not have to pay anything other than deductibles, etc.

The cashless car insurance claim facility saves you from paying any cost of repair after an accident. It is a less tedious process as it makes policyholders submit fewer documents and go through lesser formalities in comparison to the reimbursement claim process. Under this claim option, a surveyor is sent by the insurance company to analyse the extent of the damage based on which the insurer settles the claim. This type of procedure enhances the transparency that eventually builds trust among insured persons. To get your car repaired at a network garage will help you get the best repair service for your car as insurance companies bring the best garages under its network.

Renew Expired Policy for Nissan Cars

It is compulsory to carry a car insurance policy by all the car owners while driving their cars, according to the Indian Motor Tariff. Therefore, driving a car with an inactive or invalid car insurance cover is illegal, which may also get you into financial trouble as your insurer can refuse to compensate for your damage if you get involved in an accident or a mishap. After the expiration of your car insurance plan, you must connect to your insurance company or agent and try to renew your policy within the grace period of 90 days, which is provided by insurance providers in order to give you another chance of renewing your plan and saving you from losing coverage and benefits.

When it comes to policy renewal, it is the easiest way to renew it online for which you just need to visit the website of your insurance company and enter your policy number along with basic details. At this stage, you can also change your insurer and transfer your No Claim Bonus from the old insurance company to the new insurance company. Some insurance providers offer self-inspection facilities to renew your car insurance policy instantly. It is recommended that you must avoid driving your car till your policy is not renewed as it is illegal to drive without an active policy. Also, you should keep the required documents handy to present them during the inspection of your car.

Add-ons For Your Nissan Car Insurance

Explore Car Insurance

Nissan Car Insurance FAQs

-

How long does it take to renew a Nissan car insurance?

You can get your Nissan car insurance renewed in just 5 minutes with InsuranceDekho.

-

Which all insurance add-ons should be bought with Nissan cars

For Nissan Insurance, The popular car insurance add-ons opted with Nissan cars include zero depreciation add-on, engine cover, NCB (No Claim Bonus) cover and RSA (Road Side Assistance) cover among others.

-

From where can I purchase insurance for my Nissan car

You can visit our website insurancedekho.com, compare all available premium quotes for Nissan cars and select the one which best suits your requirements. With InsuranceDekho, get policy issued instantly.

-

Which insurer has the best claim settlement ratio for Nissan cars?

Acko General Insurance, Bharti AXA General Insurance and ICICI Lombard General Insurance are among the car insurers who have registered impressive claim settlement ratio for Nissan cars.

-

How can I renew my Nissan car insurance online?

InsuranceDekho makes renewal of your Nissan Insurance even more convenient. We have a safe and quick online Nissan insurance policy renewal facility. Please pay online at https://www.insurancedekho.com/car-insurance.