Top Car Insurance Plans

- CASHLESS GARAGES 8000+

- CLAIMS SETTLED 100%

- ZERO DEP. CLAIMS UNLIMITED

Maximum Cashless Garages

Over Night Vehicle Repairs

24x7 Roadside Assistance

Quick Claim Settlement

- CASHLESS GARAGES 3,100

- CLAIMS SETTLED 95%

- COMPREHENSIVE CLAIMS UNLIMITED

Towing Assistance (For Accidents)

Coverage Outside India

PSU Provider

Quick Claim Settlement

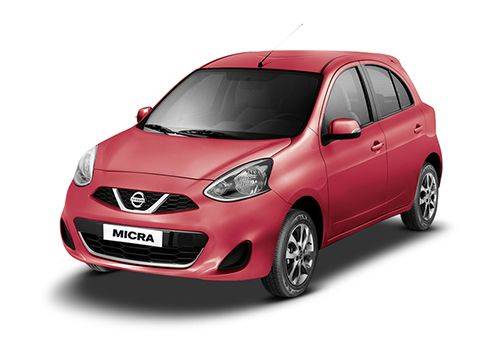

Nissan Micra Variants with Insurance Premium Price

| Variant Name | Ex-showroom Price | Comprehensive Car Insurance | Third Party Car Insurance | Own Damage Car Insurance | |

Nissan Micra XL CVT 1198 cc, Petrol | ₹5.99 Lac | ₹ 13599 | ₹ 3416 | ₹ 2157 | |

Nissan Micra Fashion Edition XL CVT 1198 cc, Petrol | ₹6.19 Lac | ₹ 13599 | ₹ 3416 | ₹ 4449 | |

Nissan Micra dCi XL 1461 cc, Diesel | ₹6.62 Lac | ₹ 13707 | ₹ 3416 | ₹ 2253 | |

Nissan Micra XL Option CVT 1198 cc, Petrol | ₹6.63 Lac | ₹ 13249 | ₹ 3416 | ₹ 3047 | |

Nissan Micra CVT XV 1198 cc, Petrol | ₹6.95 Lac | ₹ 14018 | ₹ 3416 | ₹ 3862 | |

Nissan Micra dCi XL Comfort 1461 cc, Diesel | ₹7.23 Lac | ₹ 13925 | ₹ 3416 | ₹ 3045 | |

Nissan Micra XL Option D 1461 cc, Diesel | ₹7.44 Lac | ₹ 13852 | ₹ 3416 | ₹ 2743 | |

Nissan Micra XV CVT 1198 cc, Petrol | ₹7.82 Lac | ₹ 14018 | ₹ 3416 | ₹ 3186 | |

Nissan Micra XV D 1461 cc, Diesel | ₹8.13 Lac | ₹ 14151 | ₹ 3416 | ₹ 2762 |

Calculate Your Nissan Micra Insurance Price

Select your car brand

- Maruti

- Hyundai

- Honda

- Toyota

- Mahindra

Which city is your car registered in?

- Ahmedabad

- Bangalore

- Chandigarh

- Chennai

- Gurgaon

When did you buy your car?

Nissan Micra Key Specifications

Price ₹5.99 Lakhs onwards | |

Mileage 19.15 to 23.08 kmpl | |

Transmission Automatic, Manual | |

Engine 1198 cc | |

Fuel Type Petrol, Diesel | |

Seating Capacity 5 Seater | |

Power 63.12 BHP | |

Torque 104 NM |

How to Buy Insurance for Nissan Micra via InsuranceDekho?

Nissan Micra Summary

The Nissan Micra is one of the finest hatchback cars. It is praised widely for its looks and performance. Micra is a 5 seater car that have 9 variants that comes in 6 different colours. It comes with petrol and diesel engines which runs on a manual and automatic transmission. The engine capacity of Micra is up to 1461 which makes it give a mileage of up to 23.19 kmpl. It has several attractive and safety features like an anti-lock braking system, air conditioner, power steering, driver airbag, brake assist, central locking, crash sensor, etc.

Nissan Micra Car Insurance

Car owners need to hold at least a third party insurance compulsorily while driving a car. This law protects car owners from financial liabilities towards the third party after an accident with the involvement of the insured car. To drive a car without carrying a car insurance plan is illegal and it can penalise you with a fine of Rs. 2,000 and/or jail for up to 3 months.

Types of Insurance Cover

Three different types of car insurance plans are available to secure your car:

1. Third Party Cover

It is the most basic car insurance plan that every car owner must own while driving a car. This insurance plan gives coverage against financial liabilities that you may incur towards a third party for their injuries, death or property damage incurred by them due to the insured car. The limit for property damage cover is Rs. 7.5 lakh.

2. Standalone Own-Damage Cover

This policy gives coverage for car repair expenses due to damage or loss incurred by your own car in an accident or a mishap such as fire, theft, flood, riot, and so on. Under this cover, you can include some add-on covers to expand your coverage. The policy must be bought by people who hold a third-party insurance policy as it is a compulsory insurance cover.

3. Comprehensive Cover

This is a car insurance policy that covers all aspects of car damage and loss. It gives coverage against the third-party costs as well as own-damage expenses which may arise due to an accident or a mishap. This cover allows you to add some add-on covers to your policy to extend its coverage. It is the costliest insurance cover for its extensive cover that makes it a one-stop solution.

How to Buy Insurance for Nissan Micra from InsuranceDekho?

Given below are the steps to get a car insurance plan for your Nissan Micra car:

Step 1: Visit the official website of InsuranceDekho.

Step 2: Enter the number of your car under the “Get Your Quote” tab. If you don’t know the number of your car, you can enter alternation details to continue like car’s make, model and variant, fuel type, registration year and location, etc.

Step 3: Enter your name and mobile number to find the best policy quotes for car insurance

Step 4: Compare and select a car insurance policy quote based on your needs and budget

Step 5: Pay for the chosen car insurance quotes and get its policy document via email.

Add-ons For Your Nissan Micra Car Insurance

Find Right Car Insurance Quotes by Cars Body Type

Calculate your Car IDV

Partner Car Insurance Companies

Explore Car Insurance

Nissan Micra Car Insurance User Reviews

32 Reviews

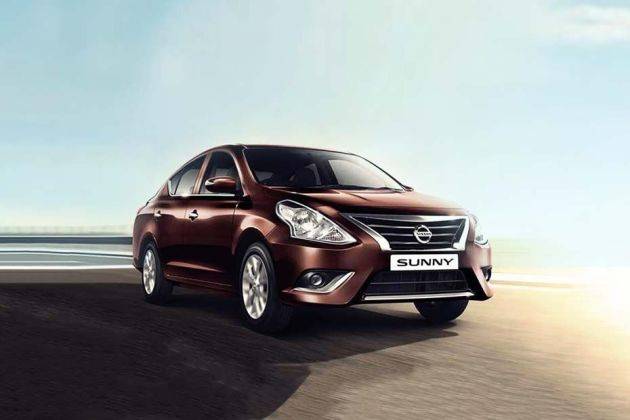

Car Insurance For Popular Nissan Cars

Nissan Micra FAQ's

- 1

Which insurer has the best claim settlement ratio for Nissan Micra cars

Bharti AXA General Insurance, Acko General Insurance, and ICICI Lombard General Insurance are among the car insurers with great claim settlement ratio for Nissan Micra cars.

- 2

From where can I purchase insurance for my Nissan Micra car

You can compare car insurance policies offered by all the top-rated insurers in India for Nissan Micra at InsuranceDekho and choose the plan which best suits your needs. With InsuranceDekho, you can purchase an insurance policy in just 5 minutes

- 3

Which are the insurance add-ons for Nissan Micra cars

The most opted insurance add-ons with Nissan Micra cars include RSA (Road Side Assistance) cover, zero depreciation add-on, NCB (No Claim Bonus) cover and engine cover among others.

- 4

What all documents do I need to get my Nissan Micra car insurance renewed?

You can get your Nissan Micra car insurance policy renewed paperlessly with InsuranceDekho. You just need to have the following details with you:

1 Previous Year Policy Number

2 Previous Year Policy Expiry Date

3 Vehicle Registration Number